how are property taxes calculated at closing in florida

To calculate the property tax use the following steps. How Are Property Taxes Handled at Closing in Florida.

How You Can Calculate Property Tax When Buying A Home

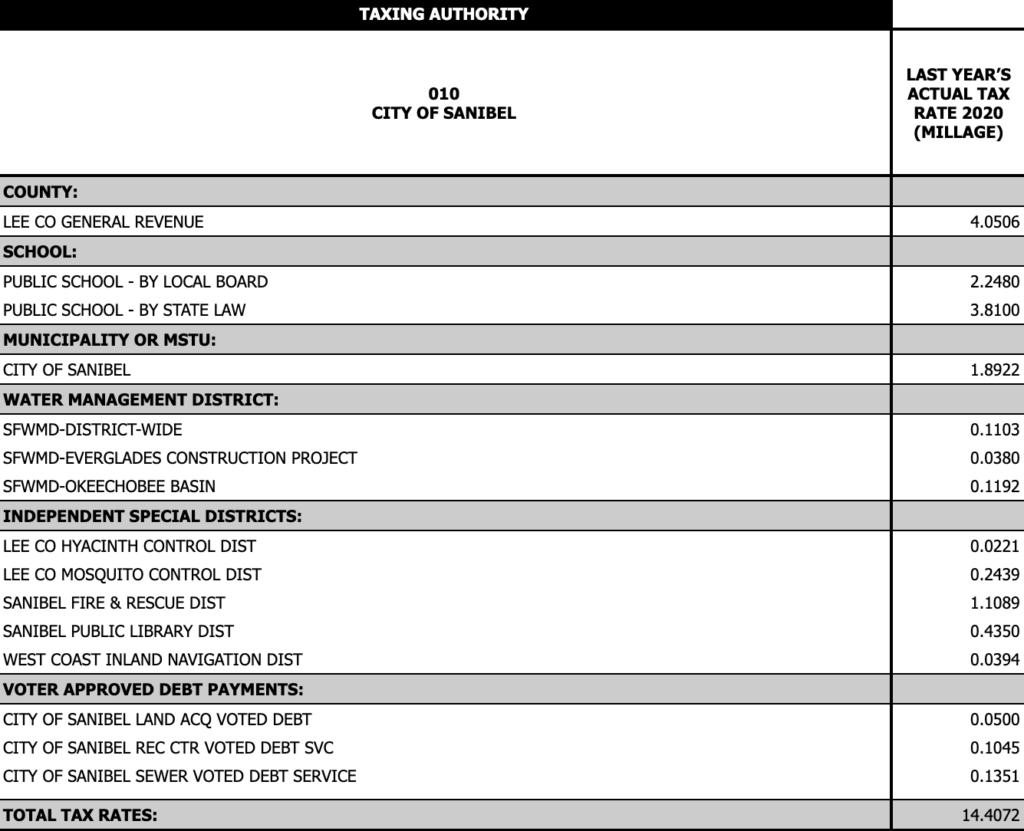

In all Florida counties except Miami-Dade the tax rate is.

. Divide the total annual amount due by 12 months to get a monthly amount due. Use this Florida Mortgage Closing Cost Calculator to estimate your monthly mortgage payment including taxes insurance and PMI. The process of calculating the property tax due at the close of the transaction can be difficult.

The basic formula is. Knowing how to calculate your property tax expense is important in knowing whether you can afford a particular home. Tax Proration and New Construction.

This proration accounts for the time that the Seller still owned the. Figuring out the amount of your doc stamps. Proportion Calculation - X sellers of days total amount tax 365 days This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your.

Generally at closing the Seller pays property taxes dating from January 1 of that year until the date of closing. In the state of Florida property taxes are sent at the end of a calendar year and are paid in arrears ie one year behind the current year. Use our Florida seller closing costs calculator to estimate how much youll owe and your net proceeds when you sell your home.

As stated before the property taxes in Florida are based on the amount required in the previous. Math is usually the responsibility of the lender or title company to whom you have a. Florida sellers should expect to pay closing.

With respect to how property taxes are handled and paid at the closing in Florida effectively the property taxes are paid by the seller through the date of the closing in Florida. Instead the seller will typically pay between 5 to 10 of the sales price and the. Customarily full-year real estate taxes are remitted upfront when the year starts.

How Much Are Property Taxes at Closing. Divide the total monthly amount due. Florida levies a Documentary Stamp Tax on deed transfers also known as a transfer tax on sellers when real property is sold.

Section K of the FARBAR AS-IS-2 revised 813 addresses how taxes should be calculated based on new home construction. Assessed Value Exemptions Taxable Value. 4200 12 350 per month.

Property Tax Closing Costs in Florida How to Calculate the Required Amount. In Florida transfer taxes are also referred to as documentary stamps or doc stamps and theyre typically paid by the seller. Enter your Home Price and Down Payment in the fields.

Then who pays property taxes at closing if it occurs mid. JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value. How are property taxes handled at a closing in florida.

In florida you should expect to.

How Are Property Taxes Handled At A Closing In Florida

Florida Property Tax Calculator Smartasset

Property Tax Calculator Estimator For Real Estate And Homes

Florida Property Taxes Explained

A Guide To Closing Costs Blog Jennifer Ferland

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Basics Of Property Taxes Mortgagemark Com

Real Property Transfer Taxes In Florida Asr Law Firm

Real Estate Tax Prorations A Florida Real Estate Exam Math Tutorial Youtube

Florida Property Taxes Explained

Handling Property Taxes At A Closing In Florida What Do I Need To Know

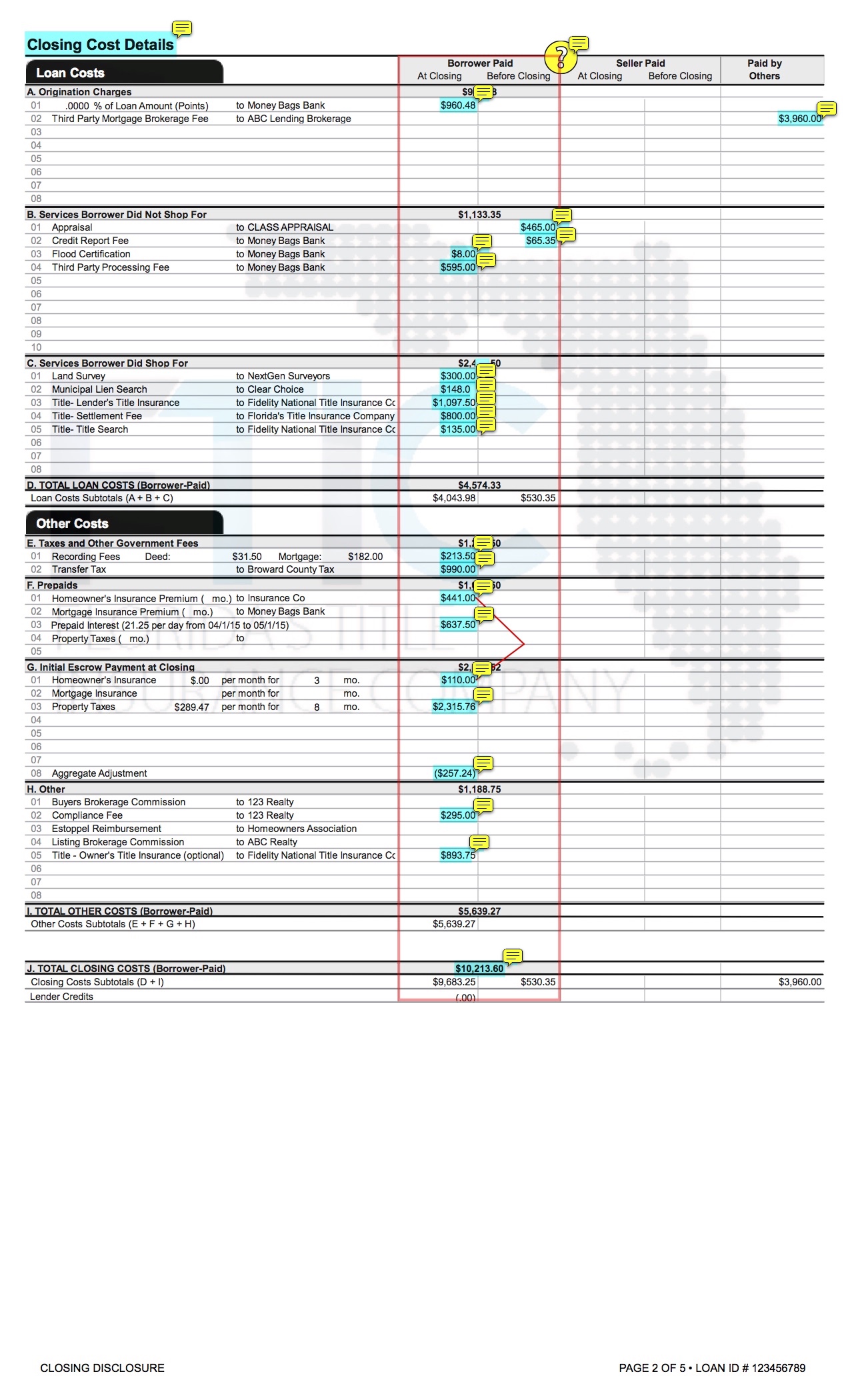

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Real Estate Tax Prorations A Florida Real Estate Exam Math Tutorial Youtube

Your Guide To Prorated Taxes In A Real Estate Transaction

Florida Property Taxes Explained

Real Estate Tax Prorations A Florida Real Estate Exam Math Tutorial Youtube

What Are Florida Seller Closing Costs Hauseit Miami

Adjustments And Prorations Of Taxes For Closing In Florida Usa